We are building the mobile bank for the next 2 Billion.

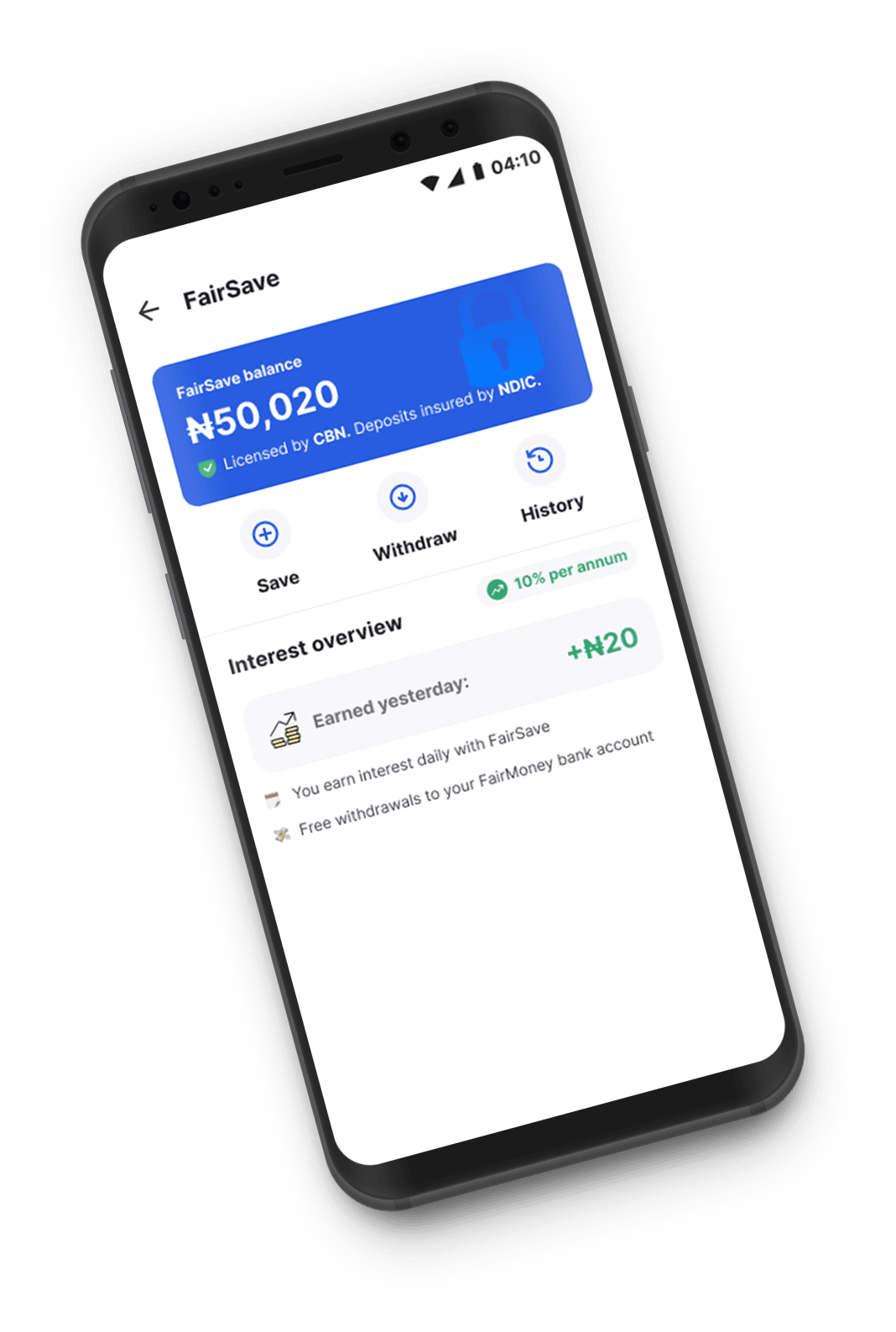

FairMoney Microfinance Bank is a leading Neobank in Nigeria that offers lending, banking, and investment services to everyday Nigerians.

Licensed by

Deposits Insured by

Scan the QR code with your phone camera to download the FairMoney app.

Trusted by millions of users in Nigeria

With a customer base of over 5 million, FairMoney MFB aims to drive financial inclusion in Nigeria using fintech.

APP DOWNLOADS

10

million+

OVER

10,000

LOANS PER DAY

USERS OVER

187,636

Trust Fairmoney with their funds through FairSave & FairLock

LOANS PROCESSED IN

5

Minutes

ALMOST

₦3.36 Billion

Saved with Fairmoney

Products that meet all your life goals

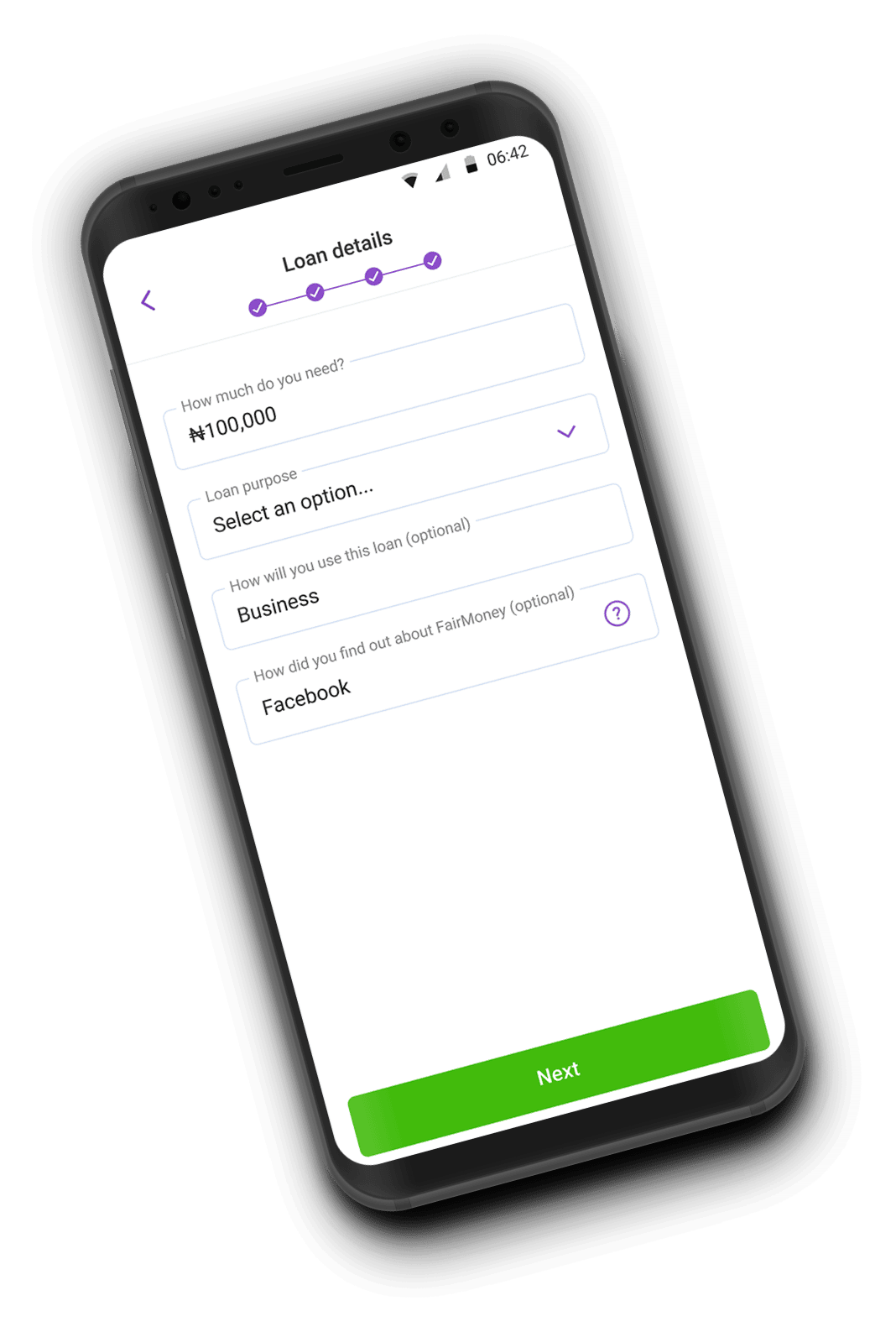

Personal Loans

Get Quick Loans In 5 minutes (Up To ₦1,000,000),No Collateral Achieve your goals faster with FairLock (Fixed term deposits) & earn up to 24% interest P.A.

Learn More

OUR INVESTORS

Testimonials

Musa

Head IT

With a customer base of over 5 million, FairMoney MFB aims to drive financial inclusion in Nigeria using fintech. We currently operate in Nigeria and India. We have reached over 3 million customers via an android mobile app only. With a customer base of over 5 million, FairMoney MFB aims to drive financial inclusion in Nigeria using fintech.

Ahmed

Developer

Great saving tool

Latest Blogs

In the News

Ready to take your finances to the next level?

Scan the QR code with your phone camera to download the FairMoney app.